Banking and Finance

Financial compliance is the regulation and enforcement of the laws and rules in finance and the capital... View more

SOX Act Section 404 Requirements Guide of Internal Control

-

SOX Act Section 404 Requirements Guide of Internal Control

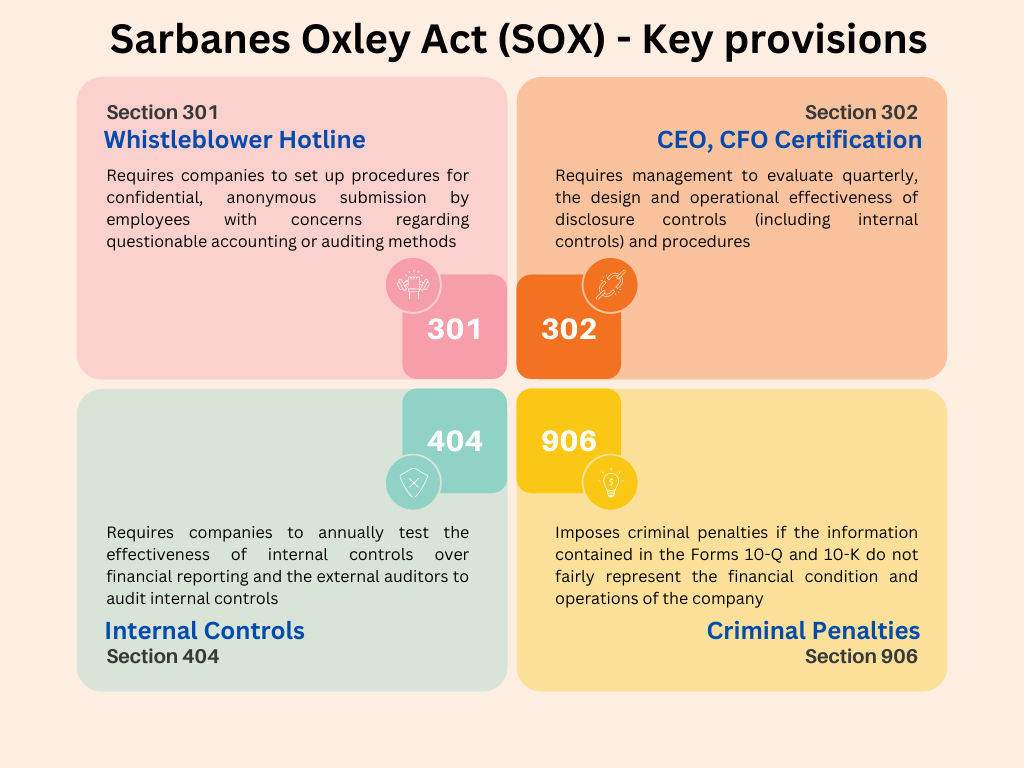

SOX Section 404 (Sarbanes-Oxley Act Section 404) mandates that all publicly-traded companies must establish internal controls and procedures for financial reporting and must document, test and maintain those controls and procedures to ensure their effectiveness. In financial auditing of public companies in the United States, SOX 404 top–down risk assessment (TDRA) is a financial risk assessment performed to comply with Section 404 of the Sarbanes-Oxley Act of 2002 (SOX 404). The purpose of SOX is to reduce the possibilities of corporate fraud by increasing the stringency of procedures and requirements for financial reporting.

The term is used by the U.S. Public Company Accounting Oversight Board (PCAOB) and the Securities and Exchange Commission (SEC). The TDRA is used to determine the scope and required evidence to support management’s testing of its internal controls under SOX404. All annual financial reports must include an Internal Control Report stating that management is responsible for an “adequate” internal control structure, and an assessment by management of the effectiveness of the control structure.

What are the rules required in Sox 404?

The Commission shall prescribe rules requiring each annual report required by section 13(a) or 15(d) of the Securities Exchange Act of 1934 to contain an internal control report, which shall state the responsibility of management for establishing and maintaining an adequate internal control structure and procedures for financial reporting and contain an assessment, as of the end of the most recent fiscal year of the issuer, of the effectiveness of the internal control structure and procedures of the issuer for financial reporting.

Internal Control Evaluation and Reporting for Sox 404

With respect to the internal control assessment required by subsection (a), each registered public accounting firm that prepares or issues the audit report for the issuer shall attest to, and report on, the assessment made by the management of the issuer. An attestation made under this subsection shall be made in accordance with standards for attestation engagements issued or adopted by the Board. Any such attestation shall not be the subject of a separate engagement.

Sox Section 404 Guide for Small Business

Section 404 of the Sarbanes-Oxley Act requires public companies’ annual reports to include the company’s own assessment of internal control over financial reporting, and an auditor’s attestation. Since the law was enacted, however, both requirements have been postponed for smaller public companies. The requirement of an auditor’s attestation won’t apply to most smaller public companies until their 2008 annual reports. The 2007 annual report will be the first year that the management assessment will need to be included.

What are the Sox 404 internal controls?

Sox internal controls include the policies and procedures that financial institutions establish to reduce risks and ensure they meet operating, reporting, and compliance objectives. Internal controls safeguard company assets, maintain the integrity of financial data/transactions, ensure compliance, support daily operations, and assist companies in achieving their objectives.

Sox 404 Specifications

All annual financial reports must include an Internal Control Report stating that management is responsible for an ‘adequate’ internal control structure, and an assessment by management of the effectiveness of the control structure.

Sox 404 Exemptions

Realizing the cost of auditing is too much for some companies, the SEC does not require non-accelerated filers or companies with less than USD 75 million in public float [i.e., the portion of shares held by public investors] to comply with section 404. The exemption also encompasses Emerging Growth Companies (EGCs) for up to a five year period.